Remember, compound interest takes a long time to work its magic. So are Acorns investment strategies good? Do these Acorns funds build wealth with good performance? Acorns Investments Performance?Īs I’ve written multiple times before, when it comes to investing, what matters far more than investment selection is the amount of money you invest, and how long you keep it invested. iShares Core MSCI Total International Stock – IXUS.These are investment-grade bonds (not junk bonds) and is designed to track the BofA Merrill Lynch US Corporate Index. iShares iBoxx $ Investment Grade Index ETF – LQD – This ETF is part of the “bonds” part of the Acorns investment portfolios.This fund is essentially one-step riskier than a money market fund. There is probably a way to take the riskiest investment in the world, combine it with short-term Treasuries and come up with a Moderately Conservative portfolio. Nothing lowers your risk like short-term U.S. iShares 1-3 Year Treasury Bond ETF – SHY – This is the low-risk investment in the line-up.So, assuming everything goes according to plan, REITs would go up when real estate is going up, and vice versa. A REIT is a way to invest in the real estate market through stocks. Vanguard REIT ETF – VNQ – This fund invests in Real Estate Investment Trusts, or REITs, and is designed to track the MSCI US REIT Index.Vanguard FTSE Developed Markets Index Fund ETF – VEA – This one of the international components of the portfolio.Specifically, it is designed to track the CRSP US Small Cap Index. Vanguard Small-Cap ETF – VB – This is the small-cap stock ETF for Acorns.Vanguard 500 Index Fund ETF – VOO – The bread and butter of stock investing, this is an index-based ETF that attempts to replicate the SP500 index by investing in large U.S.The Acorns investing ETFs are (Name, Ticker Symbol, Discussion): In other words, you can look up the Acorns ETF list for the prospectus, history, and ticker symbol on any finance website or tool you like. All ETFs are regular, publicly traded ETFs from either iShares or Vanguard. Moderately Conservative – 40% Stocks / 60% BondsĪll the Acorns funds investments are index-based Exchange Traded Funds, or ETFs.Moderate Portfolio – 60% Stocks / 40% Bonds.Moderately Aggressive Portfolio – 80% Stocks / 20% Bonds.The Acorn portfolios have changed a bit from the beginning, but are still pretty typical as far as the stock to bond ratio is concerned. The Acorns moderately aggressive portfolio splits the difference, the Acorns moderately conservative preview reverses the 60/40 to be a 40/60 portfolio, and of course, the Acorns conservative portfolio is all bonds. So, the Acorns aggressive portfolio has all stocks, while the Acorns moderate portfolio makes use of the traditional 60/40 portfolio. The five types of Acorns investment portfolios are Conservative, Moderately Conservative, Moderate, Moderately Aggressive, and Aggressive. The five portfolio types are very traditional, even if what is in them is not. The Acorns app helps you pick which Acorns investing portfolio to use based on your age and various risk tolerance questions, or you can pick for yourself.

So, let’s take a look.Īcorns has five different investment portfolios that it uses and automatically re-balances for all users. Of course, the whole point is for your automatic savings to add up and grow over time, so it is necessary to understand where Acorns is investing our money. So, let’s dive into this Acorns investing review. However, you can make lump sum, or recurring, investments with Acorns now, which may make your investment balance bigger faster. In other words, this not something to wring your hands over, especially in the beginning. For example, if you have $100 in your Acorns account the difference between 10 percent and 8 percent (whether up or down) is just $2 for a year.

That means that as far as real dollar amounts go, the difference in percentages won’t be big.

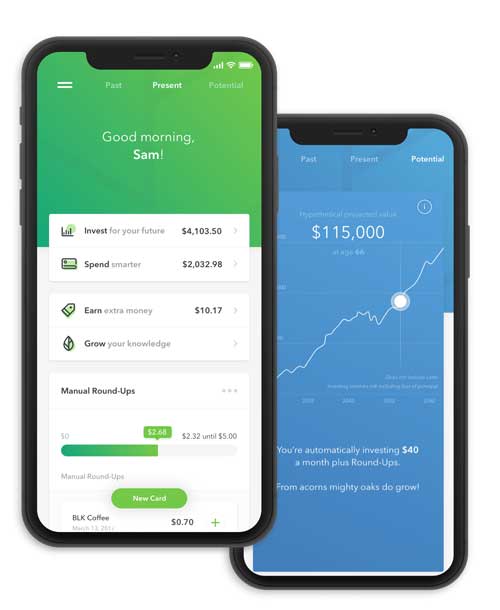

First, when you get started with Acorns, we are talking about a very small amount of money. Money is only transferred once the minimum round-up amount is $5, and it only happens once per day, unless you use the Acorns debit card or Acorns checking account.īefore we get too in-depth here, it is important to remember a few things. There are some nuances about how Acorns works you should understand first. The idea of the Acorns automatic money savings app is that it rounds up all of your transactions and automatically invests that money for you. 5 Are Acorns Investments Good? Are Acorns Investments Good Portfolios?

0 kommentar(er)

0 kommentar(er)